Guides

Perpetual Markets

Learn how to trade perpetual markets.

Contents

- Overview

- How to Place Trades

- Managing Position

- Setting TP / SL

- Closing Position

- Viewing Trade History

Overview

Perpetual futures on LogX Network provide traders with leveraged exposure to asset price movements—all on-chain for maximum transparency, security, and efficiency. Unlike traditional futures, these contracts have no expiration date, allowing traders to hold positions indefinitely while continuously settling profits and losses. With high leverage, real-time price adjustments, and seamless execution, LogX perpetual futures offer a flexible and powerful tool for hedging, speculation, and strategic trading in a dynamic DeFi environment.How to Place Trades

- Open the App

- Select a Perp Market

- Choose an Order Type:

- Choose an Order Type:

- Market Order - Executes instantly at the current price.

- Limit Orders - Executes when the price reaches your set level.

- Enter Trade Amount

- Set Leverage

- Review Trade Summary

- Size - Calculated as

Amount × Leverage. PnL and fees are based on this. - Liq Price - The price at which your position will be liquidated.

- Slippage - Potential price impact due to market conditions.

- Fees - Trading costs associated with the order.

- Size - Calculated as

- Go Long or Short

- Long – You profit if the price increases.

- Short – You profit if the price decreases.

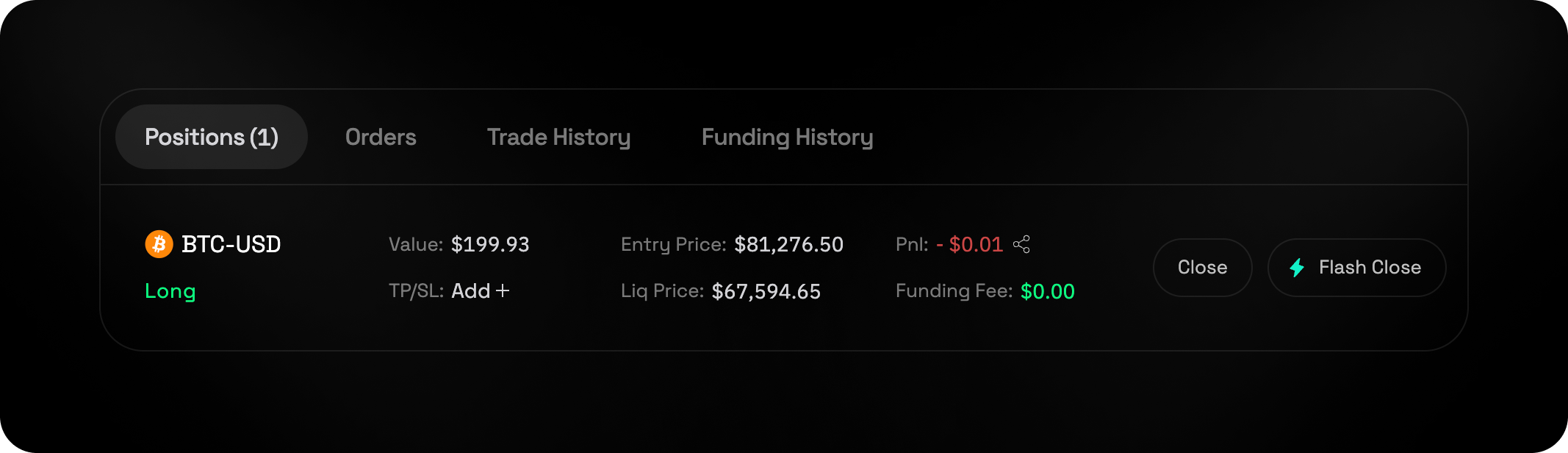

Managing Position

You can view Perp Positions underneath the chart on the trading page.

You can view Perp Positions underneath the chart on the trading page.

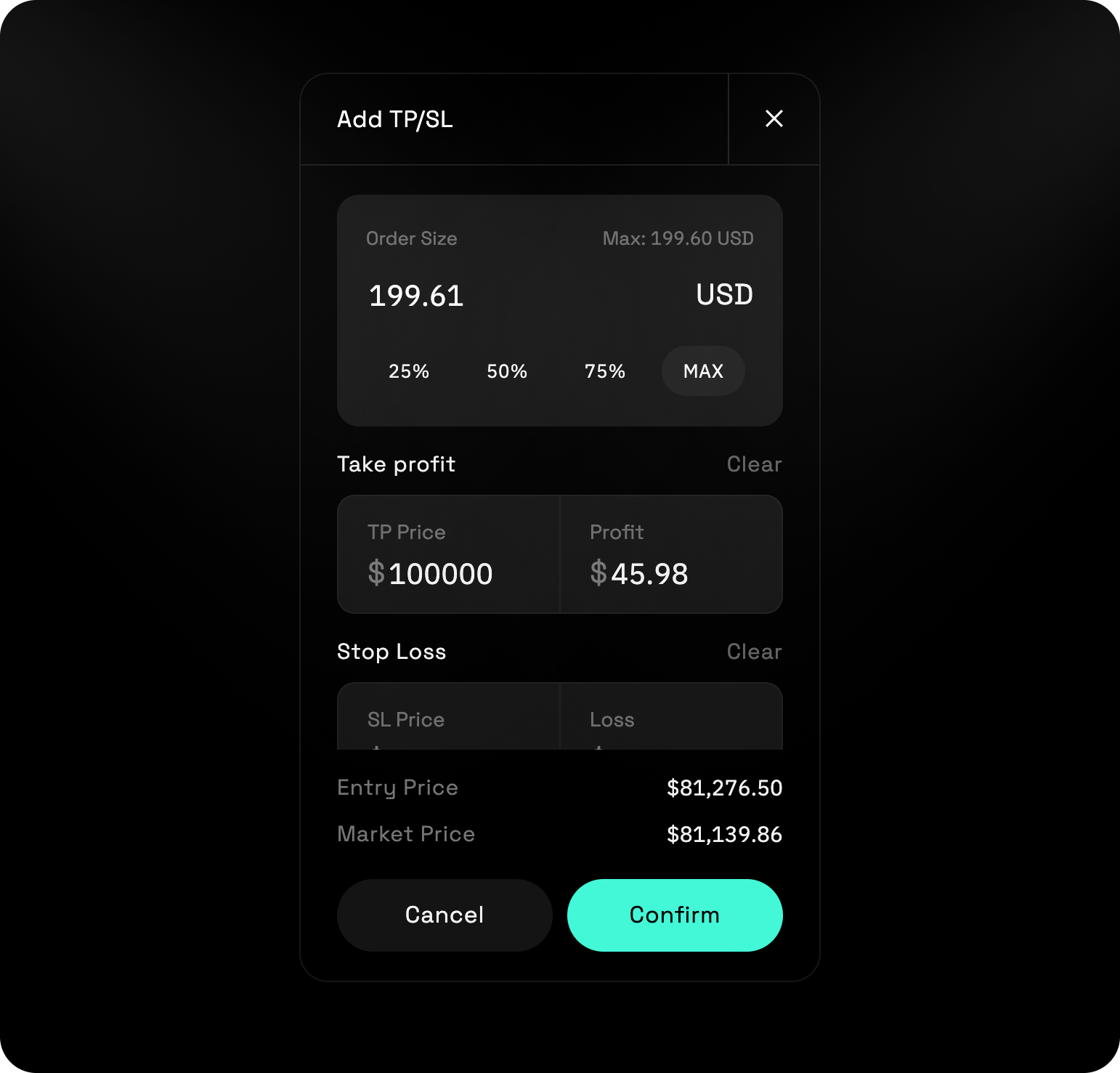

Setting TP / SL

You can add TP/SL via the Positions tab.

You can add TP/SL via the Positions tab.

- Go to the perp position on a positions table.

- Under the TP / SL column click on the ➕ Add button.

- A pop-up will open.

- Enter you take profit / stop loss price levels

- Check estimated gain or loss %.

- Press confirm

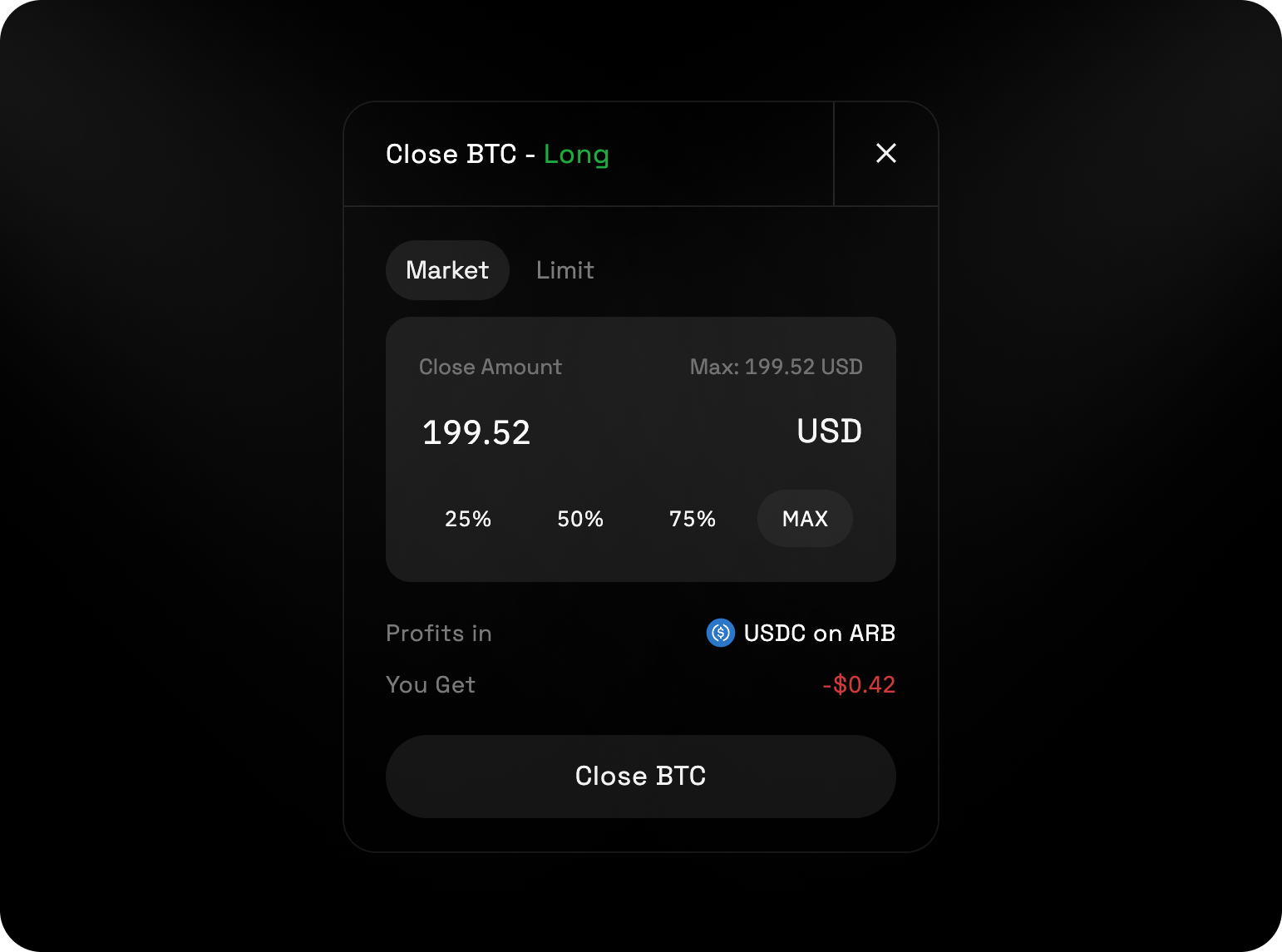

Closing Position

You can close via the Positions tab.

You can close via the Positions tab.

- Go to the position on the positions table.

- Click on the [Close] button to the right.

- A pop-up will open.

- Select the amount you wish to close.

- Click [Close Position].